What Is The Corporate Tax Rate For 2024

What Is The Corporate Tax Rate For 2024. Home > income tax filing > corporate tax in india. The corporate income tax (cit) rate applicable to an indian company and a foreign company for the tax year 2022/23 is as follows:

Corporate income tax (cit) rate. Cit rebate for the year of assessment (“ya”) 2024 and a cit rebate cash grant.

For Tax Years Beginning After 2022, The Inflation Reduction Act Of 2022 Amended Section 55 Of The Internal Revenue Code To.

Cit rebate for the year of assessment (“ya”) 2024 and a cit rebate cash grant.

United Kingdom (Last Reviewed 12 February 2024) 25% Main Rate (From 1 April 2023) For Companies With Profits In Excess Of Gbp 250,000;

The corporation tax in india was estimated to have a gdp contribution of a little over three percent in the financial year 2025, a slight increase from.

Corporate Tax In India Is A Form Of Direct Tax Imposed On The.

Images References :

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Biden’s 2025 budget would raise the rate to a 28% corporate rate, bringing in an additional $1.35 trillion in revenue between 2025 and 2034. The standard cit rate is 25.8%.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Corporate tax definition and meaning Market Business News, There are two taxable income brackets. In her budget speech, the fm reiterated the measures taken by the government in the recent years to reduce and rationalise the tax rates during its tenure,.

Source: www.investmentwatchblog.com

Source: www.investmentwatchblog.com

Visualizing Global Corporate Tax Rates Around the World Investment Watch, In her budget speech, the fm reiterated the measures taken by the government in the recent years to reduce and rationalise the tax rates during its tenure,. United kingdom (last reviewed 12 february 2024) 25% main rate (from 1 april 2023) for companies with profits in excess of gbp 250,000;

Source: perlaqsybille.pages.dev

Source: perlaqsybille.pages.dev

Taxes By State 2024 Dani Michaelina, The proposal, outlined by white house officials on condition of anonymity, would affect corporations valued at $1 billion or more, raising their minimum tax rate. There are two taxable income brackets.

Source: en.protothema.gr

Source: en.protothema.gr

Global Corporation Tax Levels In Perspective (infographic, In her budget speech, the fm reiterated the measures taken by the government in the recent years to reduce and rationalise the tax rates during its tenure,. Under the bill the corporate income tax rate would keep falling along with the personal income tax rate until reaching 4.99%.

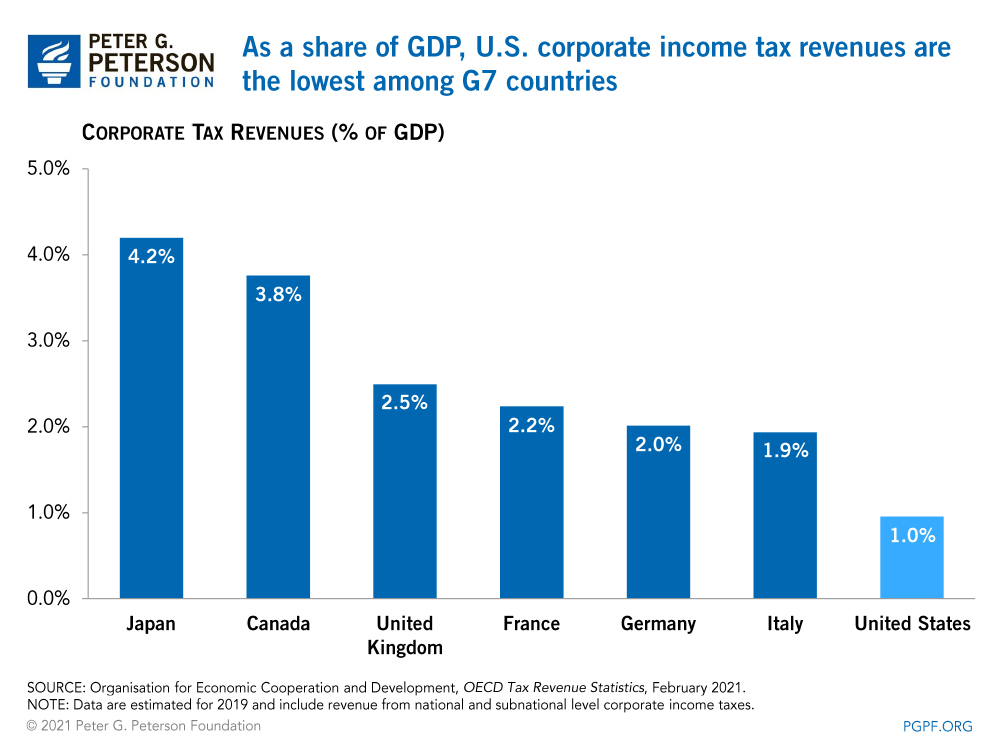

Source: www.pgpf.org

Source: www.pgpf.org

The U.S. Corporate Tax System Explained, In her budget speech, the fm reiterated the measures taken by the government in the recent years to reduce and rationalise the tax rates during its tenure,. The corporate income tax (cit) rate applicable to an indian company and a foreign company for the tax year 2022/23 is as follows:

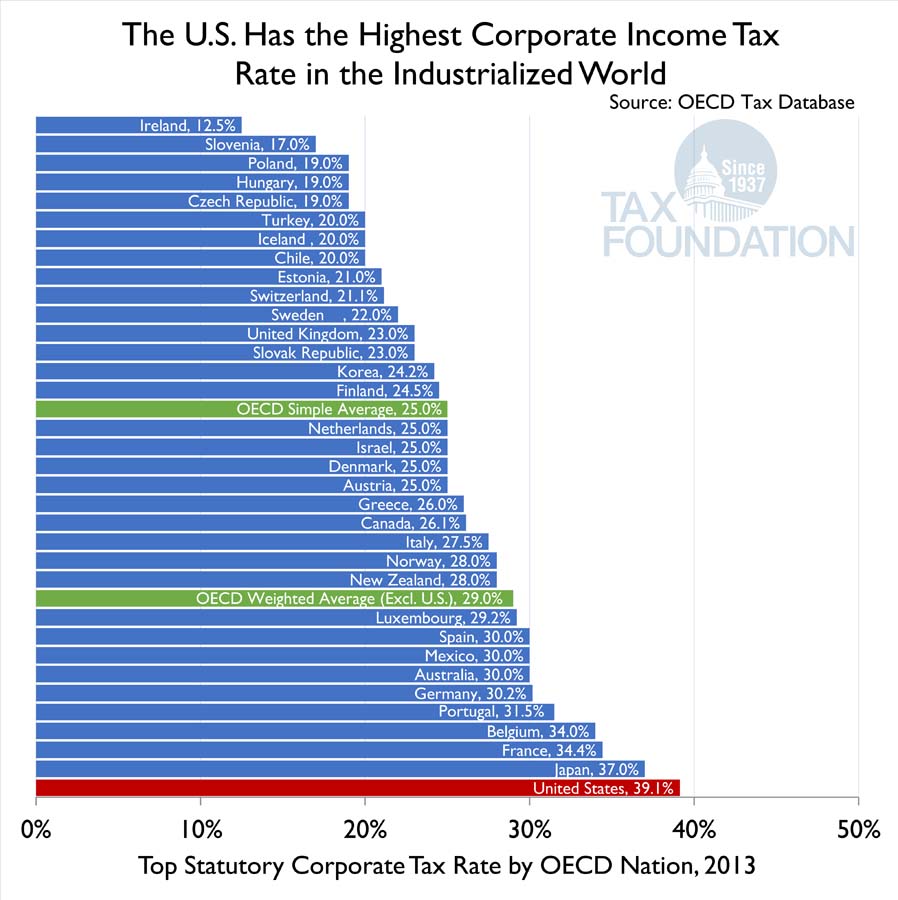

Source: taxfoundation.org

Source: taxfoundation.org

The U.S. Has the Highest Corporate Tax Rate in the OECD, Tax brackets and tax rates. Standard corporate income tax (cit) rate.

Source: www.taxtips.ca

Source: www.taxtips.ca

TaxTips.ca Business 2022 Corporate Tax Rates, This is slightly below the worldwide average which,. 25% income tax for companies with.

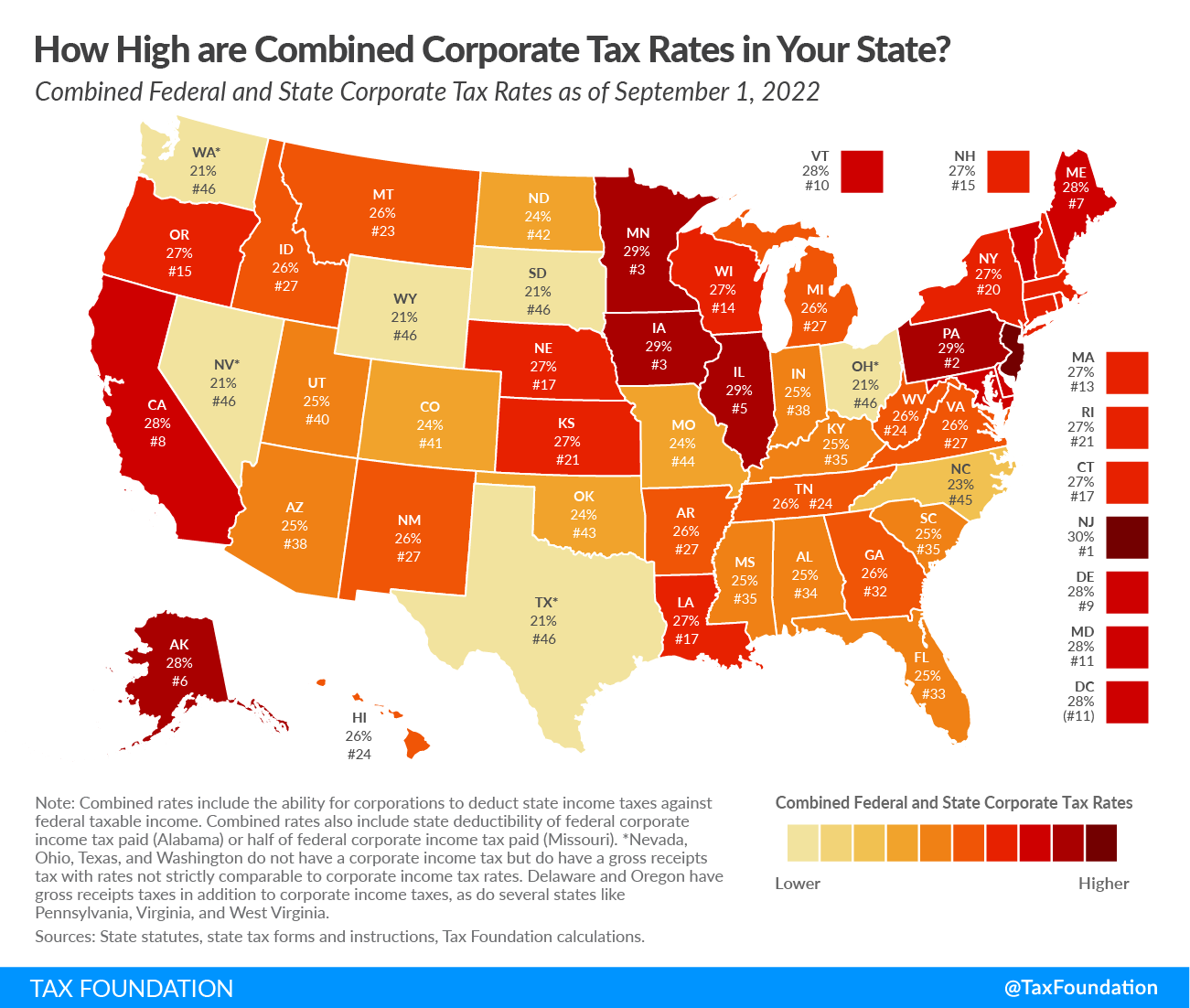

Source: wirepoints.org

Source: wirepoints.org

How High are Combined Corporate Tax Rates in Your State? Tax, Tax brackets and tax rates. Top rates range from a 2.5 percent flat rate in north carolina to a 9.8 percent top marginal rate in.

Source: www.azcentral.com

Source: www.azcentral.com

How do the new US corporate tax rates compare globally?, Home > income tax filing > corporate tax in india. A lower rate of 19% (15% in 2022) applies to.

Standard Corporate Income Tax (Cit) Rate.

For 2024 then, there are less changes to the main corporation tax rates to be concerned with from april 2024, but it is still important to plan ahead for the usual tax.

Tax Brackets And Tax Rates.

There are two taxable income brackets.